Wealth Planning

The hallmark of Shore Morgan Young Wealth Strategies is our financial planning process. Our advisors use sophisticated tools and provide a fully integrated approach to identifying solutions to produce customized financial guidance.

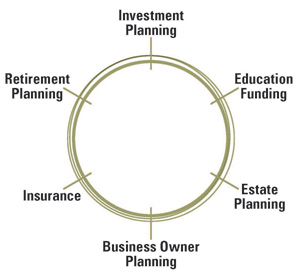

Through our financial planning process, our advisors do not evaluate only one aspect of your life, they look at the full picture. From there they develop a personalized plan that includes Estate Planning, Investment Planning, Retirement Planning Strategies. and Business Owner Planning. You can feel confident that all aspects of your financial situation are evaluated and integrated to help you achieve your financial goals and dreams.

Areas of Focus

Business Strategies

Building a business takes smart planning, determination and hard work. A solid business succession plan helps your prospering business transfer to future generations.

Education Funding

Education costs are rising, with no end in sight. You need to stay alert to changing tax rules that affect funding so you can determine the best way to pay for education - - for yourself, your children or your grandchildren.

Employee Benefits

Benefits have evolved far beyond the “cut-and-dry” health insurance plans that were popular in the years before managed care. However, if you are expected to make your own benefit decisions, you need to understand your options and the impact your choices may have.

Estate Planning

The estate tax burden imposed on your personal assets can create major obstacles in how assets are passed on, how assets are divided, and how the taxes themselves are paid. If you do not plan appropriately, your estate may be diminished, and the IRS, not your heirs, will be the recipient.

Risk Management

Risk Management plays a critical role in helping us manage the risks we face daily. Life and disability income insurance can also play a vital role in the funding of many critical financial transactions. It can provide funds to facilitate the transfer of a business or other assets to a family member. It can be a key source of financial security to families and an ideal way to help reduce the cost of estate taxes.

Retirement Planning

We all aspire to enjoy our retirement years without financial concerns. Planning adequately can help assure that you do not outlive your savings and thereby maintain your desired lifestyle throughout retirement.

Income Tax Considerations

There are many areas to consider when choosing an investment, filing a tax return, or entering into any major financial transaction. Planning ahead may help reduce or avoid some tax pitfalls.

Wealth Accumulation

Choosing the right investment may be one of the hardest decisions you will have to make. Learning about the various investment vehicles available today and how they can help you meet your objectives plays an important role in your financial future.

The Planning Process

Planning for your financial success may be intimidating, and a broad knowledge of complex investment products and elaborate tax laws is required.

With experience, knowledge and wealth management resources, our advisors can help you navigate changing tax laws, volatile financial markets, inflation and evolving personal or business circumstances. They are here to help you find the solutions toward realizing your dreams.

Throughout the financial planning process, we never lose sight of one essential element - personal service. We seek to provide the best of both worlds, the resources of a large company and the personal attention you need to establish a plan for financial success. When you partner with us, you work with a team of professionals in investment and retirement planning, education funding, insurance protection and estate and business owner planning.

Life Goals

Whether you are in the prime of your career, ready to retire, or in retirement, you have dreams for the future. To help you turn those dreams into reality, we can help you find clear solutions to complex financial issues. We know you need answers, not more questions, in your life.

Get started on your path to financial success. Please contact us so that our advisors can help develop your personalized financial plan.

Start now – it is never to late to start planning.